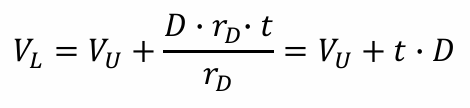

according to the lecture slides, the PV of the interest tax shield is computed by multiplying debt with the tax rate:

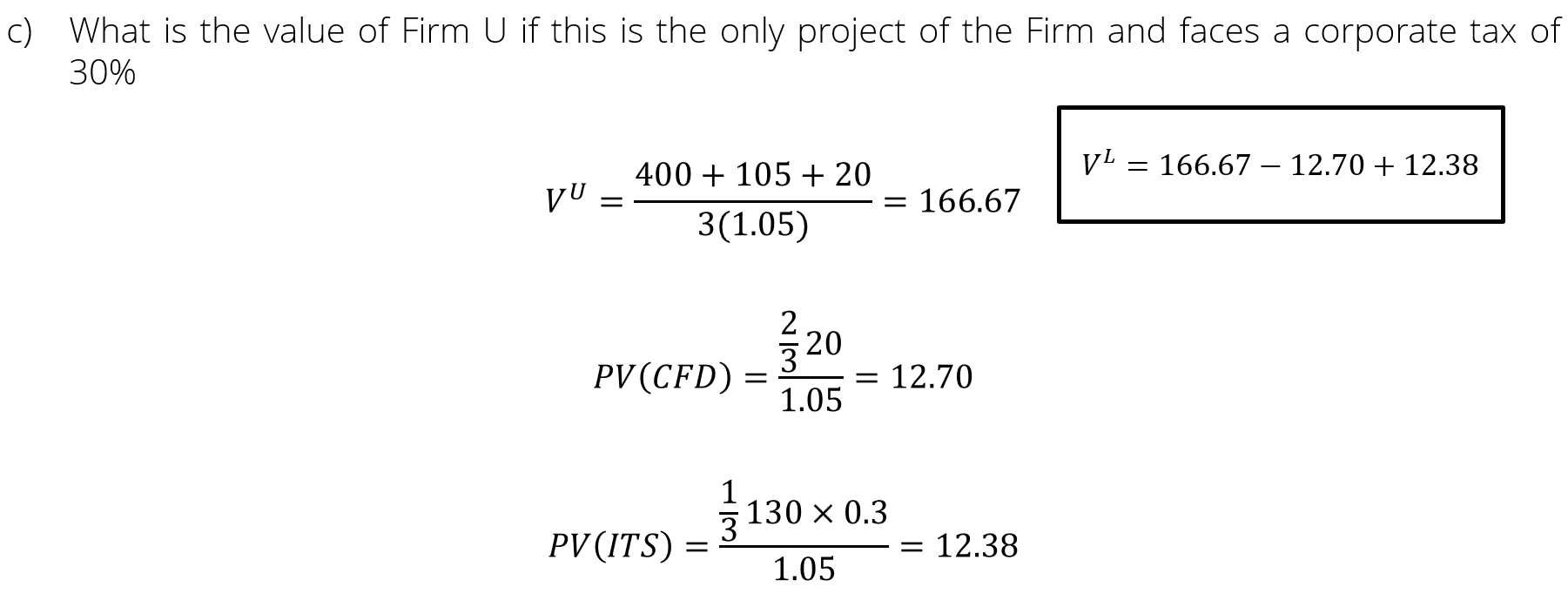

In exercise 3, however, only the interest payed is considered and also multiplied by 1/3 (which I assume is because the firm only pays interest in one scenario).

Why do we not consider the full debt payment here, i.e. 230 in scenario1 and 85 in scenario2 ?