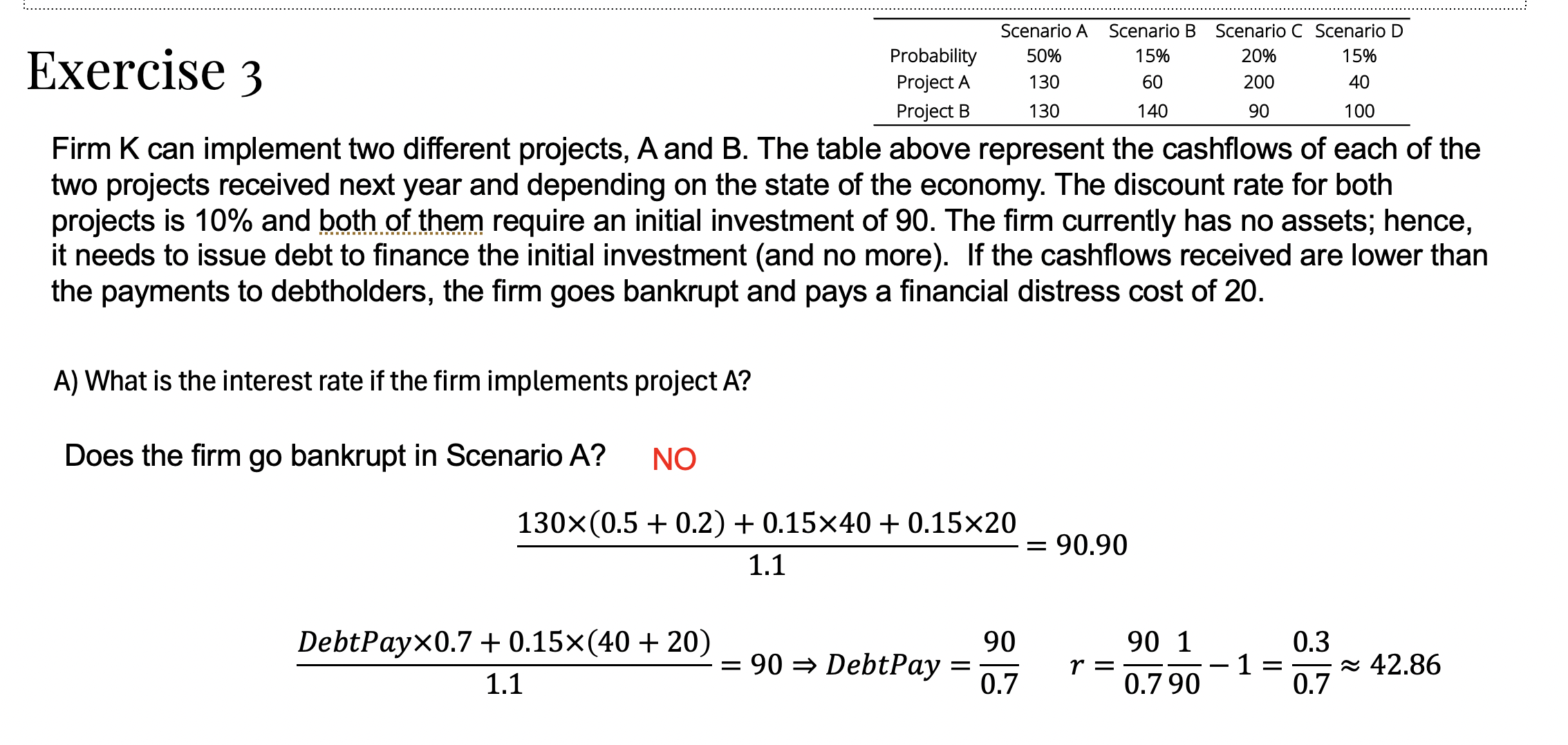

The reason we compute 130 × (0.5 + 0.2) is to test whether repaying €130 in the 70% of cases where the firm remains solvent (Scenarios A and C) would be enough for a bank to lend us the €90 needed to finance the project. Specifically, we're checking if the present value of receiving €130 with 70% probability, plus €40 and €20 in the remaining 15% + 15% cases (Scenarios B and D, where the firm goes bankrupt), is sufficient to cover the initial loan. If the answer is yes — meaning the expected repayment justifies the loan — the bank will provide the financing. If not, we must increase the repayment in the good states (the 70%) to compensate for the losses expected in the bad states (the 30%), ensuring that the total expected present value of repayments is at least equal to the €90 being lent.

I hope this is clear & correct.