Dear Professor,

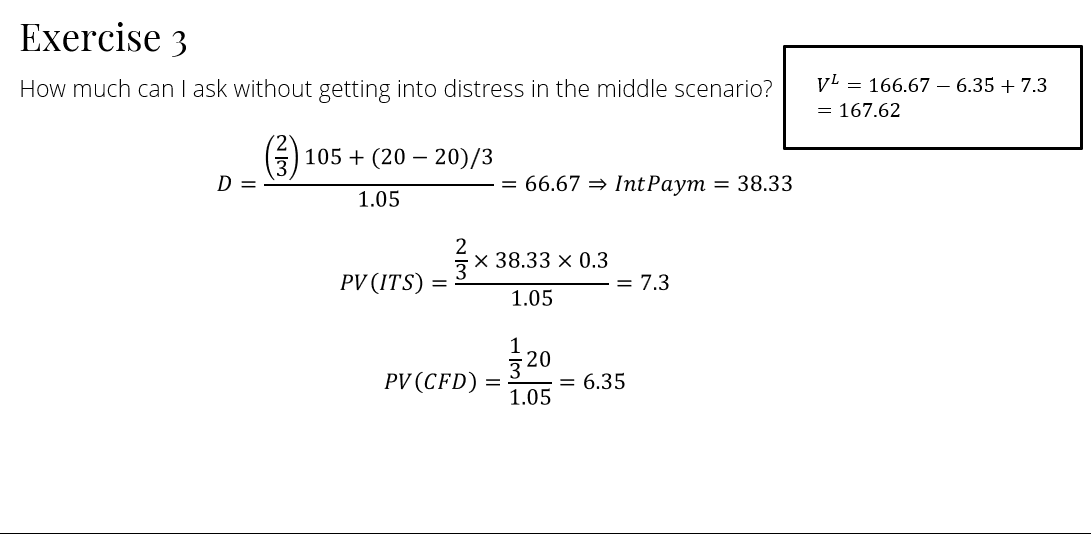

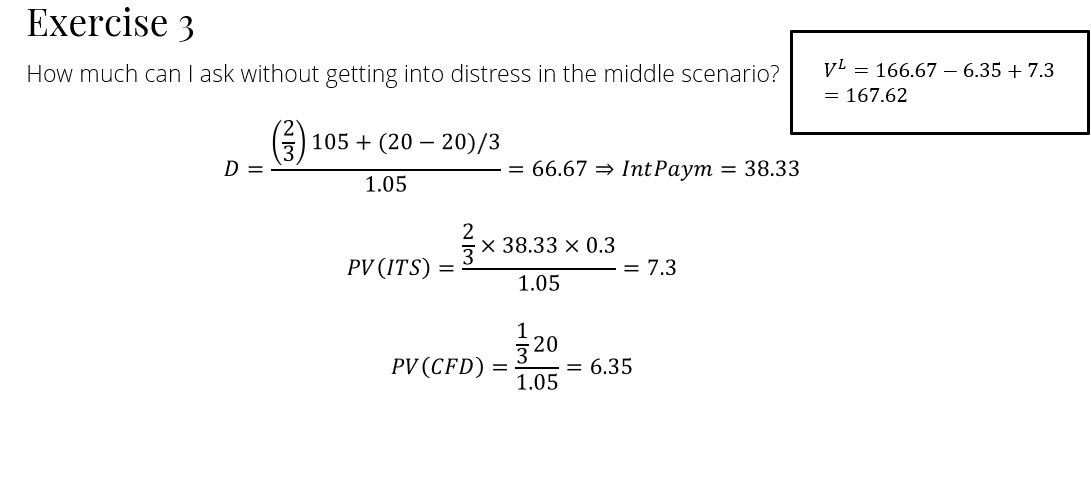

I hope you're doing well. I have a question regarding Exercise 3, point d of the slides in class for Topic 8 (Limits to the Use of Debt).

In the middle scenario, I noticed that you kept in the 2/3 and also included the 20 that is part of the third scenario. However, in the worst-case scenario, you only consider the 20 without multiplying it by 2/3. Could you please explain the reasoning behind this difference? Why is the 2/3 factor applied in the middle scenario, but not in the worst-case scenario?

Thank you for your help, and I look forward to your clarification.