Hi all,

I’ve just tried to solve this exercise and found that the solution is a bit confusing as:

- The sales uplift (+10 %) is valued at the new 40 % gross margin, over-estimating this lever

- The gross margin uplift is applied only to the old sales, under-estimating this lever

- The relative shares of the 3 synergies are not corrected for the tax effect, hence the “percentage breakdown across the three different levers” is wrong

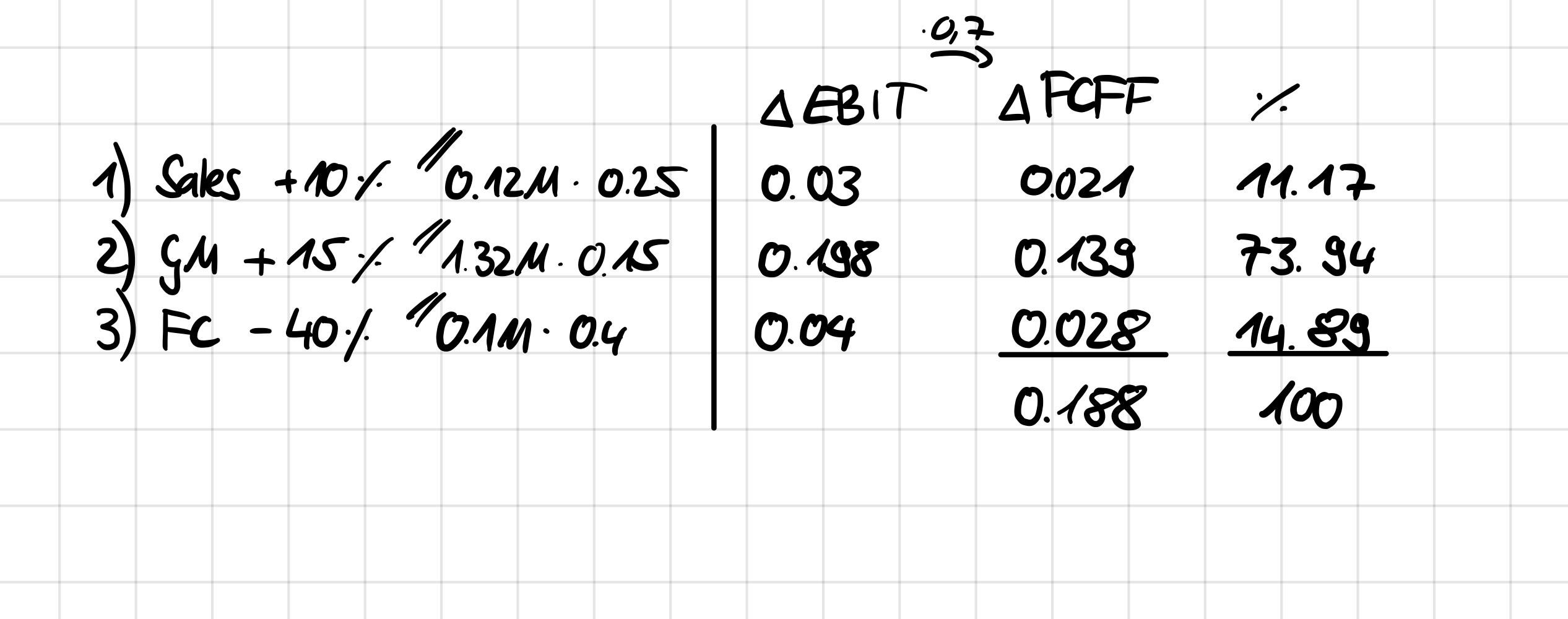

This would be my idea, which I believe provides a clean split (see screenshot).

Hope this helps – feedback welcome!