Hello Julio,

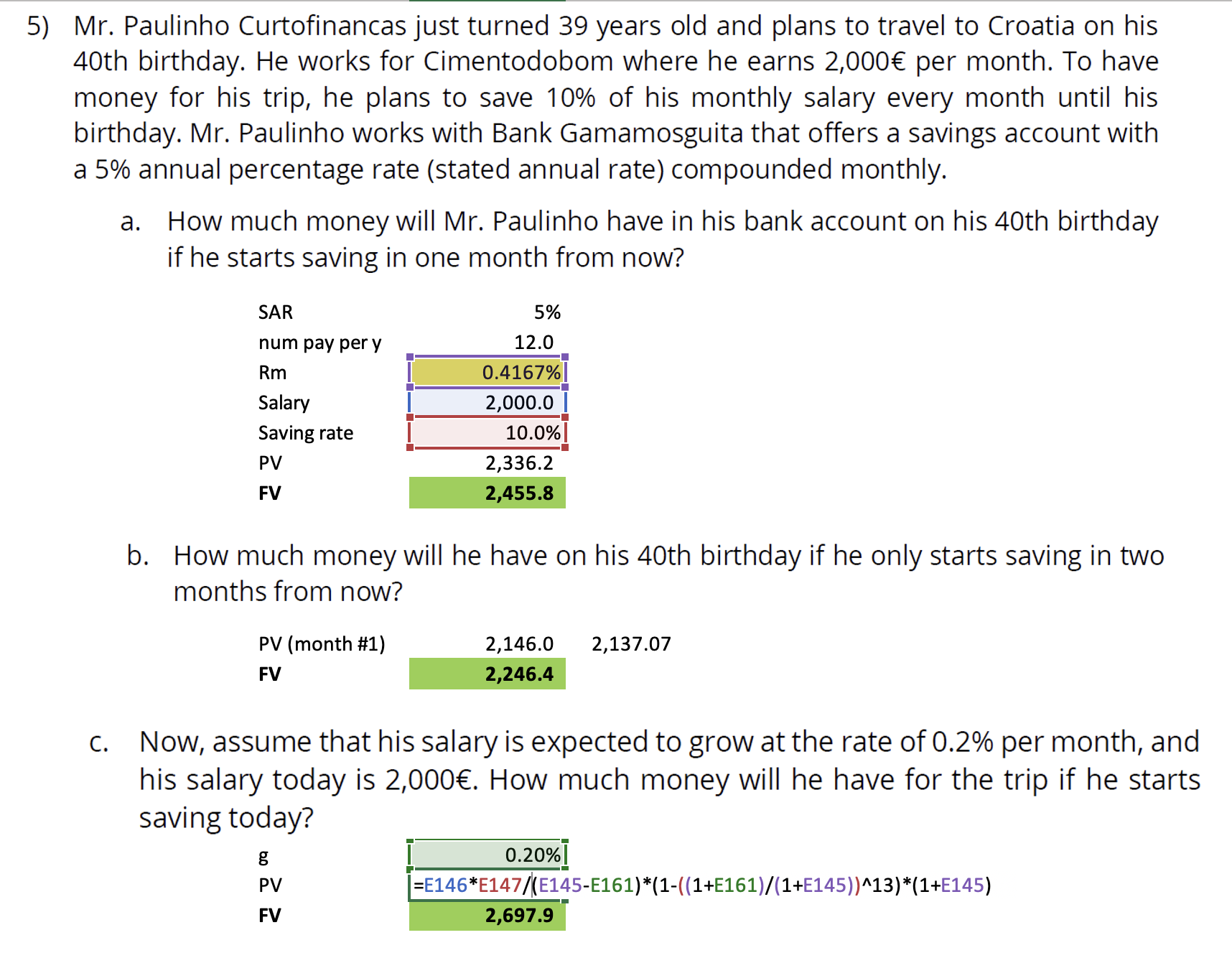

I have difficulties understanding the logic of the formula used in 5c.

As I understand it, we start saving "now" which would mean that we put aside 200€ excluding growth and then from period t=1 until t=12 we count for growth.

The growth annuity formula used assumes that he starts saving one month from now (at t=1), with the first contribution already growing at rate gg until t=13 then discounting it 13 periods (and compounding it with *(1+r) at the end).

Hence I dont understand why this solution is correct since the very first CF of "now" is equal to 200*1.002 while the exercise states that he earned 2000€ at t=0 which would be 200€.

Thanks in advance!

Eric