Hi Julio,

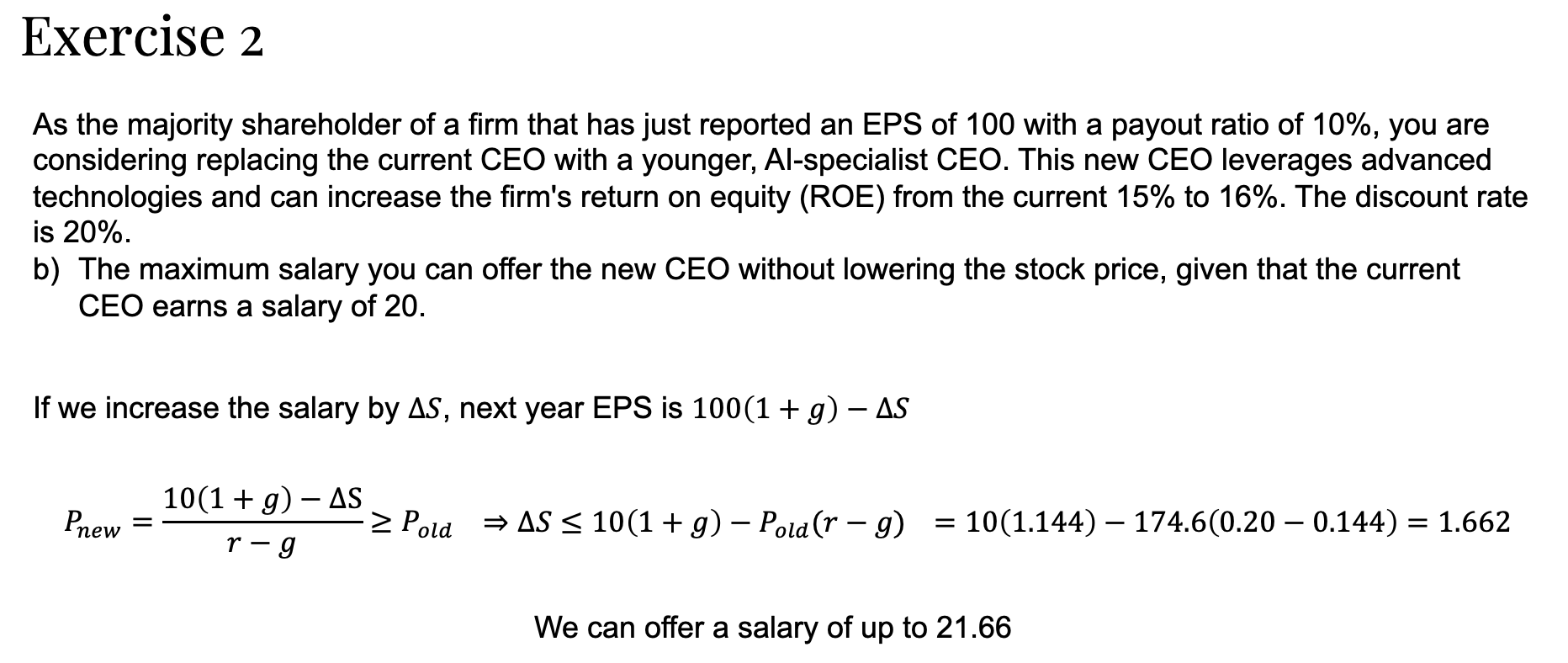

I am having some trouble understanding the solution for Exercise 2b of the in-class Stocks and Bonds lecture.

Specifically, I do not understand why DeltaS does not get multiplied by the payout ratio as well. In my eyes, we have the EPS from year 0, that grow with the growth rate of the new CEO. From this new (theoretical) EPS we then have to deduct DeltaS - the new CEO's extra salary. And only then we apply the payout ratio of 10% to the remaining EPS. In the solution the last two steps are switched around but shouldn't the CEOs salary be deducted before we ever arrive at earnings from a P&L perspective?

Thank you for clarifying!