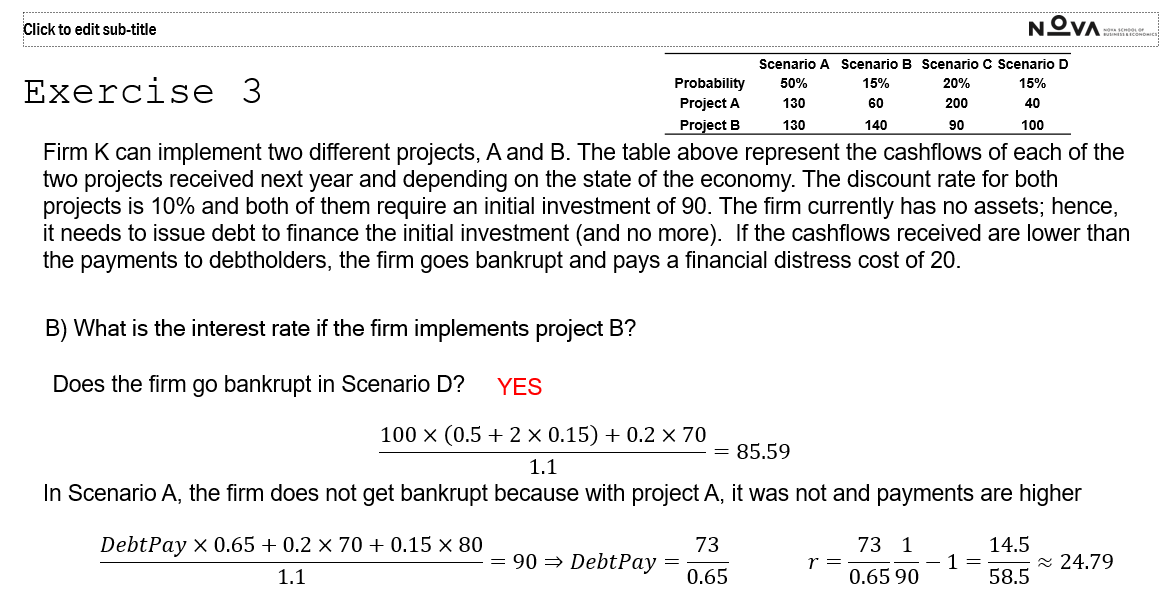

Hello Professor, I don't understand why we multiply each probability by 100. I understand we're testing if in scenario D the firm goes bankrupt or not, but nor in A nor in B the payoff is 100, so it doesn't make sense to me to compute the PV of the loan repayment with 3 100s instead of only 1 and 130 and 140. Thanks in advance