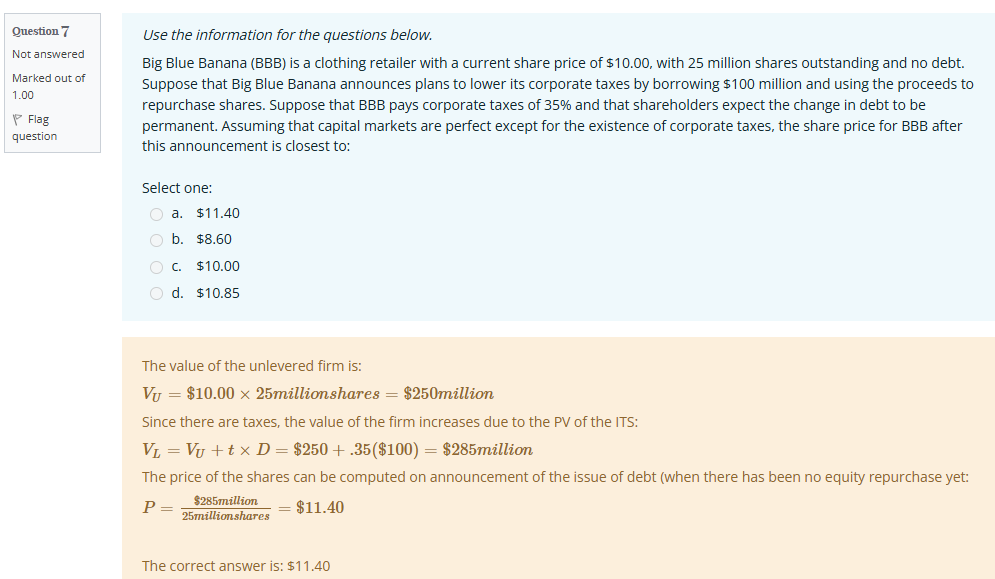

I think the key here is to see that the market reacts as soon as the announcement is made. So, even though 10 million shares will be repurchased, the market will reprice the shares immediately when the announcement is made, before any shares are bought back.

So to reflect the immediate effect of the announcement on the share price, we divide the new value (original firm value + tax shield) by the original number of shares:

New Price=(Old Value+Tax Shield)/ Original Number of Shares=(250+35)/25= 11.40

Once the shares are actually repurchased, the number of shares outstanding goes down, but the price per share stays at $11.40 — the benefit was already priced in.

To sum up:

1) The announcement of debt + repurchase increases value by the tax shield.

2)The market reacts immediately, so the benefit is spread across all 25M shares.

3)After repurchase, the number of shares falls, but the price stays the same.

Hope this is clear & correct.