Hi Salvador,

Here's how I understood it:

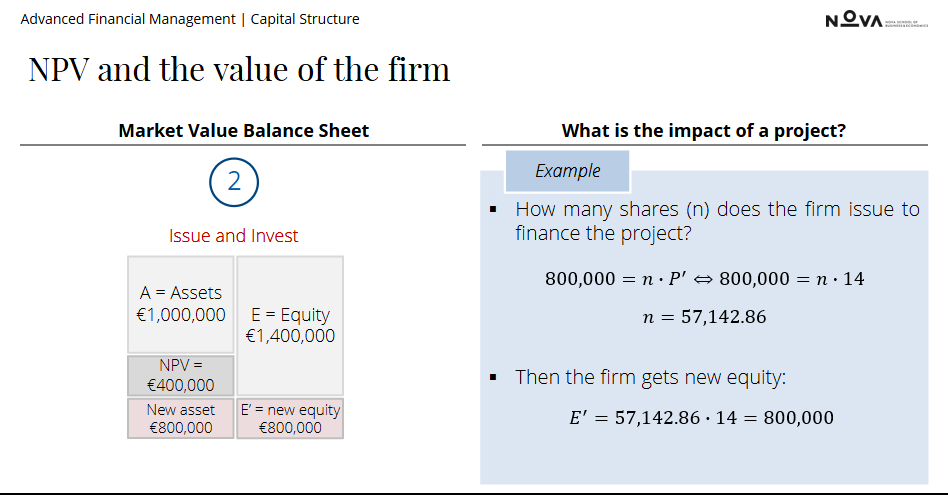

- Assets (Aktiva) side of the balance sheet: We invested €800,000 into assets, so this amount needs to be reflected on the assets side of the balance sheet. For example, if we invest €800k in machinery, these will appear as non-current assets on the balance sheet.

- Liabilities/Equity (Passiva) side: For every asset we invest in, we need corresponding capital on the liabilities/equity side of the balance sheet. In this case, the company will finance the investment by issuing new shares worth €800k (asset-equity swap).

- As I understand it, the NPV of €400k refers only to the expected future cash flows from this investment, which would be recognized on the assets side of the balance sheet under current assets. According to the cash flow statement, the €800k outflow from the investment and the expected inflows are already considered. However, this doesn’t mean that the actual value of the acquired non-current asset is reflected yet. It's simply a different perspective (cash flow vs. non-current assets).

Please correct me if I’m wrong.