I agree that it is confusing to approach this exercise from the formulas because they ask about your NPV (not the NPV of the transaction, etc).

NPV is usually simple: cashflows I receive are positive, cashflows that I paid are negative.

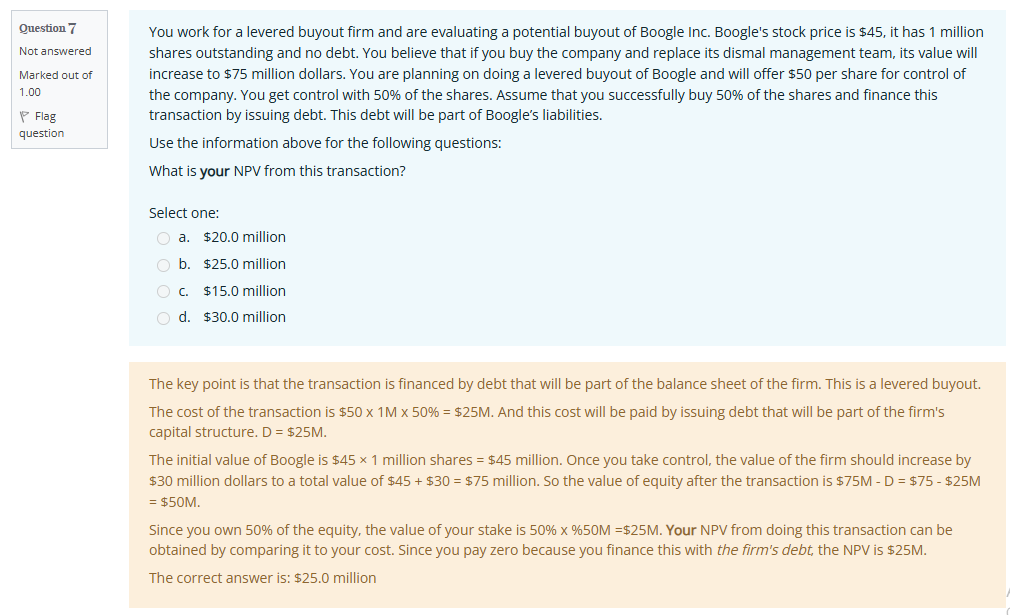

In this case, I do not pay anything because the shares are paid using debt that will belong to the firm, so I do not need to repay it

We do have positive cash flows because we will receive 50% of all the future dividends of the firm. We know that equity value is the sum of all future dividends, so we know that the NPV must be 50% of the equity value.

The equity value is just the total value minus the debt: 75 - 25 = 50. You can see how the payments to debtholders decrease equity value; hence, my NPV