Hello Julio,

I have a question about annualising multi‑year returns. In the video lecture, we simplified annualizing returns by dividing or multiplying (e.g., dividing a total return by the number of years).

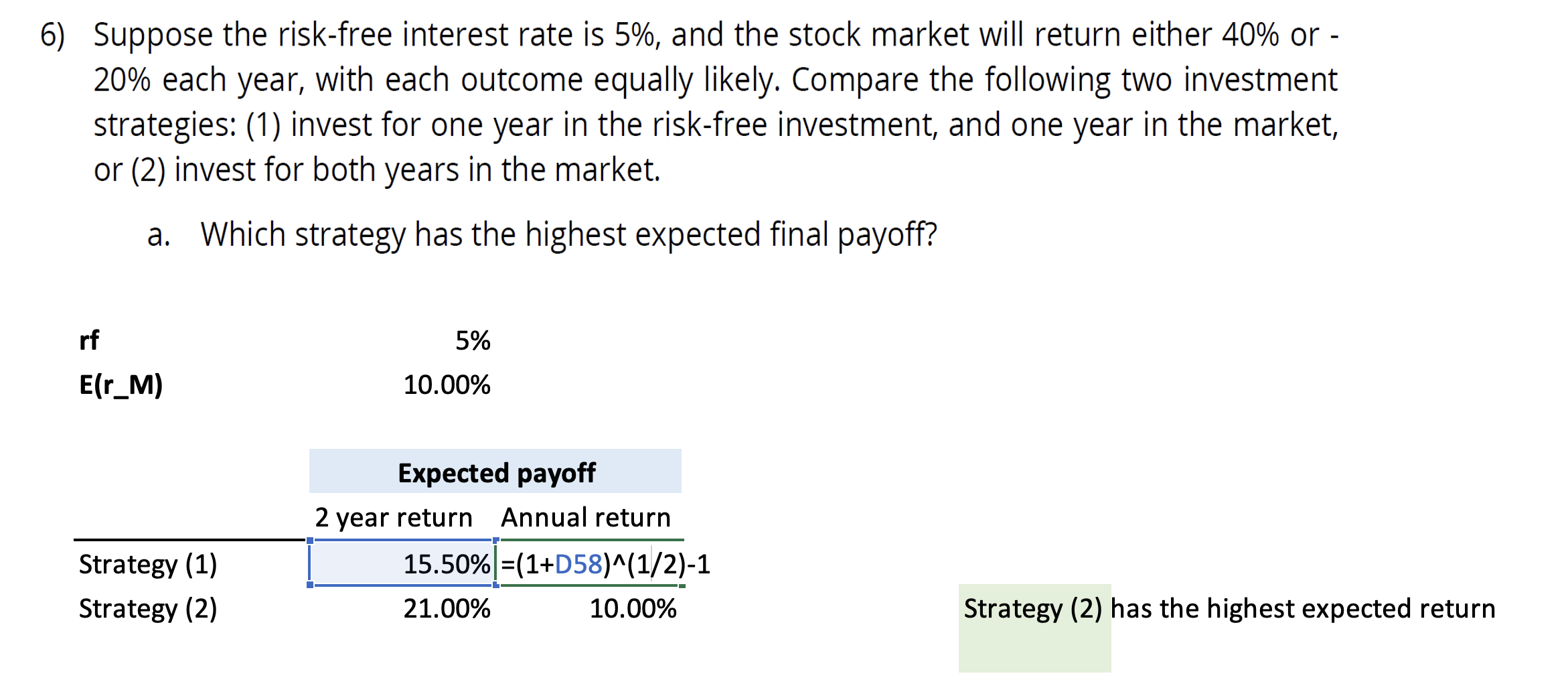

However, in our Exercise Set the annual return is calculated as:

which gives 7.47% instead of simply 15.50%÷2=7.75%15.50\% ÷ 2 = 7.75\%.

Could you please explain why we use this compound annual growth rate (CAGR) formula rather than a simple division?

What is the intuition behind compounding in this context, and when should we choose one method over the other?

Thank you for your clarification!