Hello Julio,

I am little confused about the notation of Total Risk and Total variance.

In the slides this equality is given:

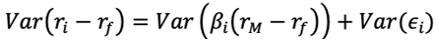

But the exact formula is:

Hence, should it not be Sigma squared in the first formula?

Moreover, when talking about Risk does it always need to be in terms of standard deviation or can it also be expressed as variance (like the variance of a stock portfolio)?

Thanks in advance,

Eric

Dear Eric,

Risk can be measured as variance or as volatility. Both are measures of risk.

The case of:

Risk can be measured as variance or as volatility. Both are measures of risk.

The case of:

\(\sigma = systematic + idyosincratic\)

pretends to be something illustrative. Risk can be decomposed into idiosyncratic and systematic, whatever measure of risk we use.