Hello Julio,

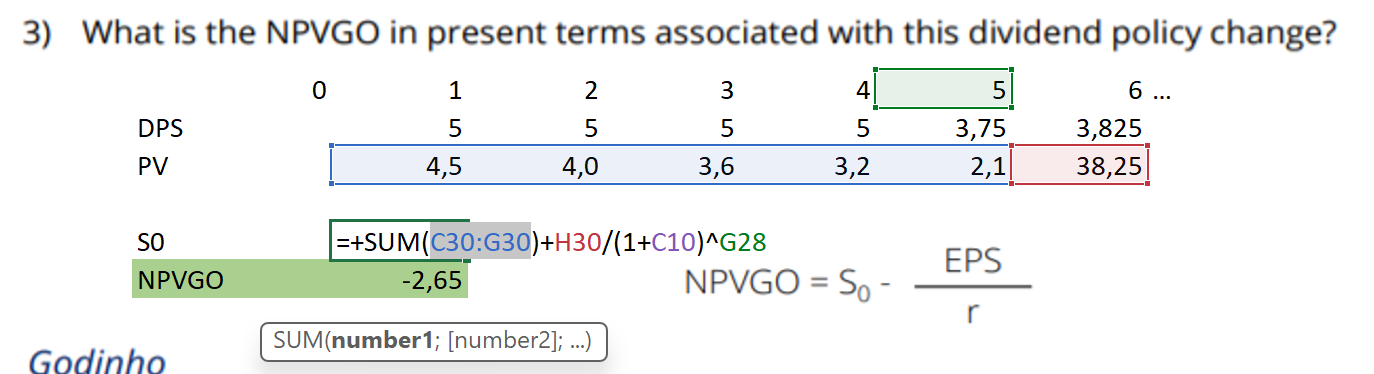

I have trouble solving this exercise since I don't really understand why the PV of the Dividends in year 6 has to be discounted again in order to calculate the share price.

Since the PV of the Dividends in year 6 already has been calculated, I thought I could just divide the sum of all PVs (55,6) by the discount rate (1,12^6).

Thanks for your help!